Shaving $AET down to size

Posted by stubbybrown in ATH, Case Studies on 2014/06/29

Name: Aetna Inc

Sector/Industry: Healthcare/ Healthcare Plans

Thesis: a long track record of solid fundamentals and accretive acquisitions has set Aetna up to be one of if not the top health insurance provider in the U.S. Top dividend grower.

Next earnings date: ~ July 29, 2014 before market opens

Risk: Medium to low: PE 14.4, forward PE 11.39, PEG 1.49

Portfolio status/Position: Core/Entry position

Last trades: Jun-26-sell @ 81.55, Jun-26-sell @ 81.31, Jun-27-sell @ 81.16, Jun-27-sell @ 81.25

Barchat.com Alpha Weighted Index: 33.20

Technical trading their: Middle

Chart Analysis: Over the last few days I have shaved down my position in AET from full position to entry level. In tandem with the S&P 500, AET has made new all-time highs while reverting to the mean. The chart below shows price levels I sold chucks of stock. Chart also shows the supporting trend line AET has fallen back to. My Price target is $85 – $87 based on analysts projections. Given the run steep slope of trajectory, I will buy & sell opportunistically but will not grow the position back to full size until more significant correction and mean reversion from the down side.

Other names I currently own are: $GTAT $AKRX $PPC TRN $MPAA $ITMN $LNC $OXY

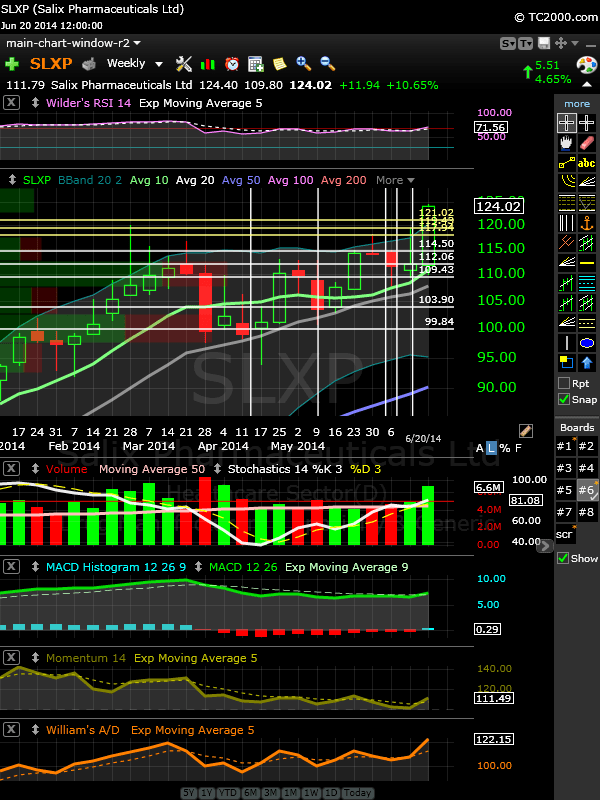

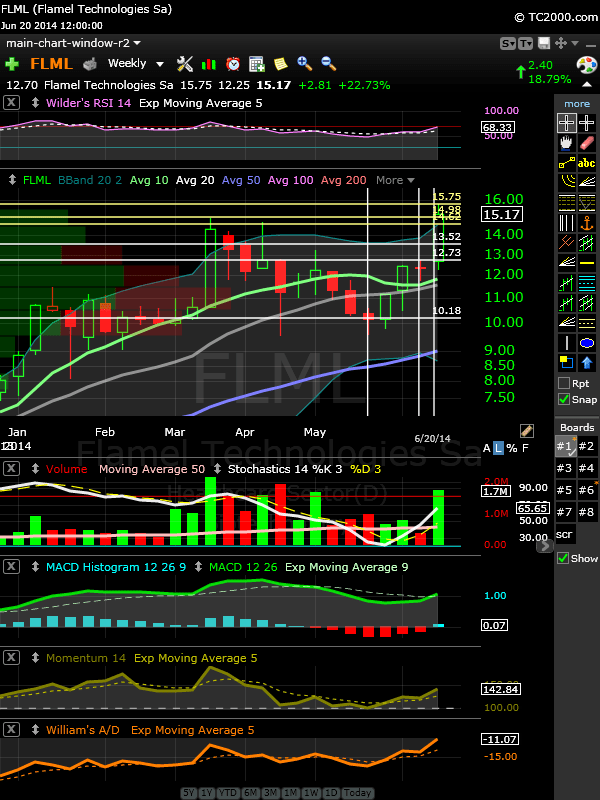

20140622 $SXLP $FLML chart analysis very similar to my recent post on $NXPI

Posted by stubbybrown in Case Studies on 2014/06/22

$SLXP and $FLML are 2 more names that populated my top long watch list on last Friday and are very similar chart-wise in my recent discussion with $NXPI. Bottom line is I’m bullish these names but watch over the next week and look for weakness as potential entry or add points. Watch their hourly behavior around the yellow lines of support.

Name: Salix Pharmaceuticals Ltd.

Symbol: SLXP – quote provided by Finviz.com

Location: Raleigh NC, U.S.A.

Sector/Industry: Healthcare/Generic drugs

Barchart.com Weighted Alpha Index Value: 90.36

Name: Flamel Technologies SA

Symbol: FLML – quote provided by Finviz.com

Location: France

Sector/Industry: Healthcare/Drug delivery

Barchart.com Weighted Alpha Index Value: 121.71

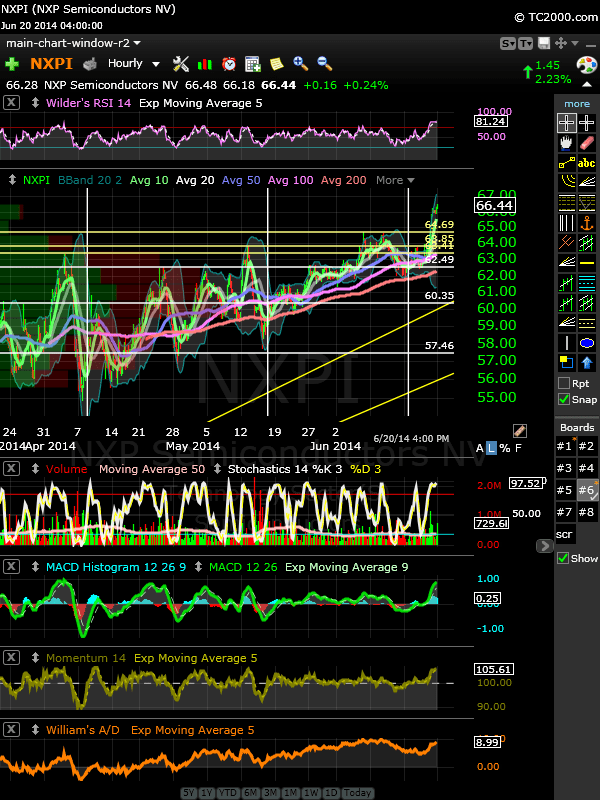

20140622 $NXPI – A technical case study and swing trade analysis

Posted by stubbybrown in Case Studies on 2014/06/22

Name: NXP Semiconductors NV

Symbol: NXPI – quote provided by Finviz

Location: Netherlands

Sector/Industry: Technology/General semiconductors

Barchart.com Weighted Alpha Index Value: 111.71

End of day Friday, June 20, 2014, my scans picked up a significant number of names (triggering bullish technical signals I watch for a regular basis) $NXPI being one of them. I’ll review my scanning techniques in another post, but this name triggered the following daily signals: daily STOCH Xup 80, vol > 50D ma, new 52 week high, new all time high. The following weekly signals were triggered as well: MACD signal Xup and Momemtum 14 Xup 5D ma. Not precisely sure when last week the weekly signals occurred. One of the tougher things about weekly signals but they are important too and not to be ignored nonetheless. More on that below.

Before I get too interested in a name just because it makes my scan and list inclusion criteria, there’s a number of things I do by looking at the chart to determine if this name is something worth paying more attention. In addition, I instituted a rule I follow which is to never to buy a name the following day I allow a name to jump on my top long watch list. I’ve gotten burned too many times buying right out of the gate. My general practice of swing trading is to buy or add on temporary short-term weakness, not strength.

In a nutshell, these are the steps I take before I populate a name on my top long watch list:

(1) Establish trend lines on the hourly, daily and weekly candle bar charts. Sometime I look at the 5 min and monthly charts.

(2) Look for and note near by support & resistance price points on the chart with yellow horizon lines.

(3) study the MACD & STOCHs first and note a pattern of oscillation with the MACD histogram study. I use Worden TC2000 for these studies are readily available. Valid MACD Xups are followed up or preceded by STOCH Xups in the same time frame. If a Xup is confirmed, I insert a white horizontal line at the close of the candle in that time frame.

(4) Then I watch for while and anticipate characteristic trending patterns based on the frequency of Xups I observed above.

(5) Only if the name meets the criteria to be included in my top watch list (another post), I’ll include it in the appropriate list.

(6) Some names trade with somewhat predictable regularity and if the pattern suites me, I may still follow the name and could decide to begin to accumulate shares at a future point of opportunity.

After doing the first 3 steps anyway, I came up with the following hourly candle bar chart:

The yellow horizontal lines are lines of support based on recent tops. Eventually $NXPI will pull back. Depending on when, these lines will be first line of support before the name breaks down below the top most white horizontal line when the last MACD Xup occurred in this time frame.

The weekly chart is interesting too. See below. Remember I noted $NXPI triggered it’s weekly MACD Xup signal and Momemtum 14 5D ma signal. Weekly Bollinger bands have tightened and the last weekly bar crossed up through the top BB, yet another bullish signal. So this name should be watched and is a prime candidate for entry on the next dip.

20140621 $OXY weekly wrap

Posted by stubbybrown in 52 week highs, ATH, Portfolio on 2014/06/21

Name: Occidental Petroleum Corp

Sector/Industry: Energy/Oil & Gas Exploration & Production

Thesis: $OXY beat last earnings estimates by $0.05 on May 5, 2014. Spinning off California assets into independent E&P seen favorable by the market sheading focus on parent company global backlog, increasing earnings growth and steadily growing dividend.

Next earning date: 7/30/14 *Est.

Risk: Low with P/E 1/2 of sector peers.

Portfolio status: Bedrock/Anchor. Level of investment is full. Buying strategically only on dips more than 5% below most recent 52 week high.

Last trades: On 20140617 buy @ 102.35, on 20140613 buy @ 101.93.

All time high/52 week high: $117.89 May of 2011 /$104.14 on June 21, 2014

Price target: $115

Technical trading tier: Lowest

Chart Analysis: Weekly chart below shows $OXY is just about reached a level of resistance drawn at 104.36. Levels are based on prices going back a ways based on much different boundary conditions on the economy. Levels should be taken with a grain of salt. So this is trading approach I’m implementing. Watch the hourly charts and in particular when MACD Xup it’s signal. If stochastics Xup 80, consider that a signal to buy if stochastics Xdown 80 for a short period time and Xup 80 very soon after. Look for daily MACD Xup, daily stochastic Xup for confirmation.

stubby’s holdings review $AE $CBOE $CELG $CME $FNGN $GMCR $HBI $LNKD $MDSO $MGA $MMLP $NKE $OCN $RKT $ROST $TRIP $VXX

Posted by stubbybrown in Portfolio on 2013/06/13

commentary:

- during yesterday’s (20130612) rout, i unloaded $COO $CBRL $IEP $V.

- today i picked up some stocks that were on my radar this week and last week such as $HBI $OCN $RKT.

- these that i picked up today $GMCR $LNKD $MDSO $ROST $TRIP were based on improving technical indicators.

- stocks that popped up on my radar today that i don’t hold but find interesting are $CYH $LL $PRAA $RH.

- i also like the following that were on my watch list for this passed monday $AMG $VRX $CAM $WDR $UHS $BEAV $COG $GILD $DNKN $BIIB $HEI $ASPS $WDC $TYL $LIFE $FLT $CSGP $BBSI.

- i also trimmed back my $VXX position but still hold some.

- top performers i help prior to today $AE +7.8%, $CME +2.57%, $MGA 2.15%, $CBOE +1.88%, $FNGN +1.83%, $CELG 1.82%, $NKE +0.57%, $MMLP +0.07%

- newly added holdings finished $MDSO +3.8%, $RKT 3.71% $OCN +3.58%, $LNKD +2.93%, $ROST 2.85%, $GMCR 2.18%, $TRIP +2.09%, $HBI 1.91%

new holdings charts:

xUP signals on my radar $OCN $FOSL $ALGT $MGA $CTRX $IEP $CYH

Posted by stubbybrown in Technical Alerts on 2013/06/11

10DMA xUP 20DMA: $OCN

10WMA xUP 20WMA: $FOSL

10WMA xUP: $CTRX $IEP

weekly STOC xUP: $ALGT $MGA

weekly MACD xUP: $CYH

stubbystock holdings as of EOD20130611 $AE $CBOE $CBRL $CELG $CME $COO $FNGN $IEP $MGA $MMLP $NKE $V

Posted by stubbybrown in Portfolio on 2013/06/11

finviz daily charts.

these are the only holdings in my portfolio. just beware. i’m breaking my rules on with FNGN. float short is 15.86%. normally i stick to < 5%.

more details forthcoming.

stubby’s watchlist for 20130610 $BEAV $CBRL $CME $COO $CYH $FNGN $OAS $OTEX

Posted by stubbybrown in StubbySelect Screens on 2013/06/09

UPDATE: i included 2 tabular representations of the watchlist included herein. technical buy signal indicators are color coded for additional qualitative review.

on friday, june 7, 2013, names on the list below popped up on at least 1 technical scan alert i maintain in my worden TC2000 TA application (or more in some cases). in another update i’ll tabulate these names according to technical signal scans, IBD ranking and any other noteworthy filter criteria. most are familiar stubby mentions including a few first-timers. the names listed in the title made new 52wk highs.

REMEMBER: stubby does NOT chase names based on popularity or speculation but looks for potential buy opportunities based on sound technical & fundamental setups. stubby also likes diversification for balance. stubby is very active in the market but I DO NOT day trade.

list: AE AMG ASPS BBSI BEAV BIIB BWLD CAB CAM CBRL CME COG COO CREE CSGP CYH DNKN DPZ FCFS FLT FNGN FSLR GILD GPOR HEI JOBS LAD LIFE LL MFRM NKE OAS OTEX PDCE…

View original post 15 more words

stubby’s watchlist for 20130610 $BEAV $CBRL $CME $COO $CYH $FNGN $OAS $OTEX

Posted by stubbybrown in StubbySelect Screens on 2013/06/08

on friday, june 7, 2013, names on the list below popped up on at least 1 technical scan alert i maintain in my worden TC2000 TA application (or more in some cases). in another update i’ll tabulate these names according to technical signal scans, IBD ranking and any other noteworthy filter criteria. most are familiar stubby mentions including a few first-timers. the names listed in the title made new 52wk highs.

REMEMBER: stubby does NOT chase names based on popularity or speculation but looks for potential buy opportunities based on sound technical & fundamental setups. stubby also likes diversification for balance. stubby is very active in the market but I DO NOT day trade.

list: AE AMG ASPS BBSI BEAV BIIB BWLD CAB CAM CBRL CME COG COO CREE CSGP CYH DNKN DPZ FCFS FLT FNGN FSLR GILD GPOR HEI JOBS LAD LIFE LL MFRM NKE OAS OTEX PDCE PRLB PRXL REGN RKT SODA TSLA TYL UHS VMED VPRT VRX WDC WDR

finviz charts

out of the market

Posted by stubbybrown in Commentary on 2013/06/04

the market needs to correct and re-assemble a new global growth thesis. from a technical stand point, the market had gotten extremely overbought over the last couple of weeks. let’s see what the next several weeks bring.

ugly market conditions $SPX $DJIA $COMPQ $STUDY

Posted by stubbybrown in Commentary, Portfolio, Technical Alerts on 2013/05/31

today i unloaded a number positions as it’s possible the market is heading toward a correction (down 10% or more from recent high is technically what a correction amounts to). if i had done nothing, the portfolio only dropped by 0.78% while

- $SPX dropped 1.43%

- $DJIA dropped by 1.36%

- $COMPQ dropped by 1.01%

- MORNINGSTAR LARGE VALUE $MLVL dropped 1.57%

- MORNINGSTAR LARGE CORE $MLCR dropped by 1.52%

- MORNINGSTAR LARGE GROWTH $MLGR down by 1.27%

- MORNINGSTAR MID VALUE $MMVL down by 1.19%

- MORNINGSTAR MID CORE $MMCR down by 1.22%

- MORNINGSTAR MID GROWTH $MMGR down by 1.22%

- MORNINGSTAR SMALL VALUE $MSVL down by 0.72%

- MORNINGSTAR SMALL CORE $MSCR down by 0.8%

- MORNINGSTAR SMALL GROWTH $MSGR down by 1.09%

- see market barometer @ http://www.morningstar.com/

this weekend i’ll provide a little detailed analysis and update my portfolio holdings.

stubbystock portfolio review [EOD20130530] $MDSO $CPA $FLT $GILD $CREE top list by IBD rank

Posted by stubbybrown in Portfolio on 2013/05/30

symbols in alphabetical order: BBSI, BOFI, COG, COST, CPA, CREE, CSGP, DPZ, FLT, GILD, MDSO, MPC, SHOS, TYL ,UHS, UNF, VAL, WAB, WDC, WDR

finviz charts: in alphabetical order

stubbyrank criteria using IBD SmartSelect data:

- IBD composite rating: 80 or up

- IBD rs rating: 80 or up

- IBD eps rating: 70 or up

- equities are sorted in excel by 1, 2, 3 from above in that order. shifts ranking toward momentum rather than fundamental selection.

- typically i like to hold stocks with <5% float short. BOFI CREE DPZ are <10%.

stubbyallocation rules for constructing a diversified portfolio: (brief summary)

- i pick a benchmark that fits my thesis for at least a quarter going forward. then i use stubbyselect screens to look for additions to balance the portfolio as close as reasonably possible to the benchmark. currently, i am allocated to small/mid cap growth. the allocation is a close mix between ishares russell 2000 growth index etf IWO & ishares midcap growth index etf IWP.

- in addition to stubbyselect screening, i target long setups whose prices are reasonably close to each other and buy positions of shares in fractions based on a target total capital outlay. if i target $20K – $24K, positions may start in 1/4 or 1/8 positions. when i buy a long position, the cost of buying and selling the position ought not be more than 1/4 to 1/2% of that positions cost. i can achieve this using Interactive Brokers as my stock broker.

- to start with i equally share weight all purchases. years of backtesting have demonstrated my portfolios generally outperforms the benchmark by a handy margin over the course of several ups & downs over a year period of time. as the market moves, i’ll add or subtract positions based on technical buy or sell indicators. sometimes this results in being out of balance with my benchmark for some short periods of time.

- positions will be sold when they approach 1-3% loss when market technicals are very shaky. during strong uptrend markets i might let losses approach 5-8% if the stock is a leader and i feel there’s a good change of technicals turning in favor of the stock. positions with gains in the 15-30% range will be reduced or sold entirely.

- i take great advantage of worden tc2000 (the same people who produce freestockcharts.com) as my TA app and i set alarms based on price, volume and a whole host of technical indicators like cross ups or cross down in MACD, RSI, STOCHASTICS, CCI etc. worden does not integrate with my broker but i can manually setup automatic stop/loss trades based on my TA in tc2000 if i wish. i’m not a day trader which allows me more flexibility. for example, every now and then you may hear about mini or micro stock market crashes. prices suddenly drop 10% or more and then recover in 5 – 10 mins. an automatic stop/loss could lose a trader lots of money. this is a good segway to my next rule.

- i always keep large amounts of cash handy. i occasionally buy bond etfs and only under certain circumstances will i purchase inverse, levered inverse etfs or volatility tracking etfs. however i have lots of experience with inverse levered etfs and understand their weaknesses and advantages. prior to the 2008-2009 market collapse i developed a delta neutral arbitrage algorithm based on long/short etfs for a particular index which resulted in producing an oscillator to measure bullish or bearish market trends. i found the algo to be no more reliable than conventional oscillators as market conditions substantially improved. i do not trade options.

- i will bend these rules only when i think there is a high probability of obtaining exceptional short-term gains or to maneuver away from outsized losses.

in another post i’ll talk about my info gathering routines to look for catalysts for stock i hold or am watching, news to stay on top of market sentiment and i follow the domestic & global bond market like a hawk, currency indexes, precious metals futures and commodities sometimes. these can be proxy indicators for future supply and demand effecting the economy and the consumer in particular. another topic i will is how i use analytics in the morningstar.com personal portfolio manager and sites i rely on during earnings season.

current asset allocation: provided by morningstar.com personal portfolio manager.

worden charts of top 5:

9 stubbyselect mentions [EOD20130529] $CVI $BIIB $FLT $GILD $VRX and more

Posted by stubbybrown in StubbySelect Screens on 2013/05/29

symbols in alphabetical order: ACT, BIIB, COG, CVI, FLT, GILD, LIFE, VRX, WDC

disclosure: stubby is long FLT, GILD, WDC

finviz charts: in alphabetical order

stubbyselect criteria:

- population of equities scanned: IBD50, IBD BigCap 20, IBD NewAmerica, IBD 8585, IBD MainTable, ST50, BarChart Top100. date of lists as of 2013-05-27

- stock price > 50 daily

- percent shares held by institutions ranks between 75.00 and max (worden tc2000 specific)

- latest short interest ratio ranks between min and 75.00 (worden tc2000 specific)

- YTD % change > 40

- price history above 20DMA

- price history above 50DMA

- short float <5% (filtered @ finviz)

- IBD composite rating: 80 or up

- IBD rs rating: 80 or up

- IBD eps rating: 70 or up (results sorted in that order to obtain rank)

- NOTE: today’s stubbyselect screen was NOT the same as yesterday’s. today;s list of stocks is not focused around any particular technical signal or indicator. so today’s list is very general. in the future i will start categorizing stubbyselect criteria in more defined classifications.

results & ranking:

worden charts of top 5:

18 stubbyselect 10DMA xUPs [EOD20130528] $VRTS $AMG $FLT $PKG $BEAV and more

Posted by stubbybrown in Technical Alerts on 2013/05/28

symbols in alphabetical order: AE AMG AMP BEAV BLK CI DIS DISCK EVR FBHS FLT GEL LVS MANH PKG UHS VRTS WAB

disclosure: stubby is long UHS, WAB

charts: in alphabetical order @ finviz. NOTE: DISCK is not listed at finviz.

stubbyselect criteria:

- price crossing up 10DMA

- short float <5%

- IBD composite rating: 80 or up

- IBD rs rating: 80 or up

- IBD eps rating: 70 or up

Learning Techniques in Swing Trading

Posted by stubbybrown in Commentary on 2014/02/21

Greetings all to 2014!

Since September 2013, I’ve been implementing and tweaking techniques in swing trading versus position investing. Swing trading is not day trading but holding periods for swing traders can be anywhere from less than a day to several months. I found this style of trading to be more suitable and rewarding to me personally.

Everything I’ve learned prior to changing styles of trading is still pertinent and very applicable to swing trading. The biggest difference between the two styles of investing/trading is that time frames to make decisions are more compressed with swing trading. Secondly, the swing trader must be willing to take on more risk and volatility. So understanding and determining risk/reward is critical to achieving success in addition to establishing well defined entries and exits ahead of entering a position.

I have been using Worden TC2000 (currently ver 12.4) to develop (1) watch lists designed for swing trading, (2) using alerts based on a variety of technical conditions more frequently and (3) developing my own scans to find stocks with the greatest potential to meet my goals. If I can explain my methodology in simple enough terms to help somebody, I will have achieved my ultimate goal in maintaining this blog. Shout out to all my friends and colleagues at StockTwits and Twitter who have liberally shared their insights with me to progress to this point.

MJ

Leave a comment